Carbon Offsets vs Credits vs Cap and Trade vs Carbon Allowances (Learn the Difference!)

Several policies have been made since the creation of carbon markets.

And although unique, each serves the purpose of reducing or mitigating the effects of carbon dioxide on the environment and climate at large.

So, with several concepts like carbon offsets, credits, a cap-and-trade system, and carbon allowances, how do you know which one benefits you or the environment?

Let’s find out below…

Carbon Offsets vs Carbon Credits

Carbon offsets are programs seeking to neutralize a company’s or an individual’s carbon emissions. In a nutshell, these programs have eco-friendly projects under them that are geared towards finding greener, sustainable solutions for greenhouse emissions.

When you buy these offsets, you’ll be investing in these green projects that work to reduce the total carbon emissions.

A good example is when a business decides to invest in an offset project to cancel out the effects of the emissions from employees’ air travel. A business may also buy offsets to make up for the amount of carbon it will give off to generate a product or service.

But it’s not just about businesses! As an individual, you may also choose to invest in a solar project to offset the emissions you give off through your daily commuting.

Buying these offsets generates carbon credits as a way of currency in this “trade”.

That said…

A Carbon Credit is a special type of permit that allows a business to emit a set amount of CO2 or other types of greenhouse gases.

The idea is that one credit is equivalent to one ton of CO2 (or some other greenhouse gas).

All the companies that buy credits are only allowed to release carbon/greenhouse gases up to a predetermined limit set by the government and it reduces yearly. This is referred to as a “cap-and-trade” system.

And so the governments incentivize more and more companies to cut their greenhouse emissions.

Part of the reason is that the limit keeps getting lower and buying credits from other businesses to exceed their cap is also becoming pricier. But more on that later!

Differences

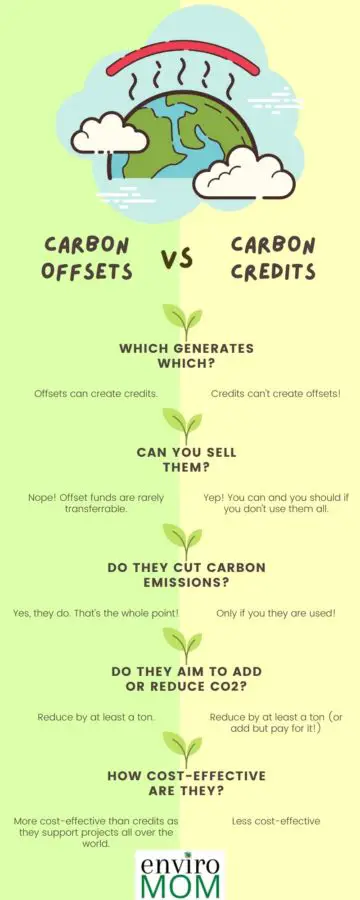

- Carbon offsets can lead to the creation of carbon credits while carbon credits cannot create offsets.

- You can sell carbon credits but you can’t sell offsets as the funds directly go to multiple projects and are rarely held in a transferrable form.

- Carbon credits do not necessarily cut carbon emissions but offset projects do. This is because carbon offsets support renewable energy, biomass, and other sustainability initiatives.

- Carbon credits allow businesses to add at least a ton of CO2 into the atmosphere (but pay for it!) while carbon offsets aim to reduce carbon by at least the same estimate.

- Offsets can reduce carbon emissions in a more cost-effective way than credits as the projects can be carried out anywhere in the world.

- Carbon offsets also facilitate educational opportunities, create jobs, support technological transfers, and bring socio-economic benefits to communities.

Similarities

- Both offsets and credits have the same impact in terms of carbon dioxide reductions and benefits to the environment.

- Both use 1 metric ton of CO2 equivalent as the standard estimate.

Cap-and-Trade and Carbon Allowances

In a cap-and-trade plan, the overall amount of greenhouse gases that are allowed to be emitted every year is determined by the government. Governments normally arrive at this amount depending on the goals and agreed targets they pledge internationally.

The total amount set by the government is what we refer to as the “cap” and is sold as carbon allowances. It keeps reducing as time goes to meet a final yearly emissions target. Take the net-zero by 2050 by the UK as an example.

Now, as the cap keeps decreasing, it also leads to lesser carbon emissions by the industries to meet the allowance set by the government.

In the US, for instance, the cap-and-trade system has been in use since the 1980s. It was put in place to curb the acid rains brought about by the nitrous oxide and sulfur dioxide that polluted the air in those times.

Businesses working under the voluntary carbon market may on some occasions have extra carbon allowances at the end of the year.

In such cases, the businesses may opt to trade their extra allowance to other firms in need. This mainly includes bigger corporations that may have exceeded or are almost exceeding their carbon limit and need to top up so as not to go against the carbon mandate.

To put it more clearly…

Governments create and distribute emission quotas using auctions. This, then, compels firms to focus more on reducing their pollution levels so that they can sell their quota balances at the close of the agreed period.

As a result, the price of emission quotas ends up largely controlled by the market under the cap-and-trade structure.

Bottom line: Cap, because there’s a threshold. Cross it and you’ll have to pay bigger tax. Trade, because you can sell your credits if you don’t need to use them all.

Note: Carbon allowances are mainly bought by businesses or companies working under the mandatory carbon market.

What Does All This Mean?

Now that you know how all these concepts work, how do you figure they impact you as an individual, a business, government, or the environment?

1. For You as a Person

As an individual, you can now voluntarily choose to counter the effects of your personal carbon footprint through the various offset programs.

The good news is that most of the available carbon offset vendors have fantastic calculators that help one estimate the amount of carbon they add to the environment.

But what if you don’t know how to go at it alone? You can then choose to buy from businesses that are actively offsetting their operations!

2. For Your Business

This is regardless of whether you’re trading under the voluntary or compliance market.

If you have signed up your business for carbon offsetting, chances are that it may affect how you run your business.

This is mostly when it comes to your energy options. With the growing participation in carbon offsets, you may realize that your company will be better off finding effective yet sustainable power solutions.

Doing so will keep you one step ahead and future-proof to the looming policies that’ll probably bind more organizations to greener methods of operation.

One last thing is that participation in the carbon market as a whole may affect your eventual cost of goods and services.

Depending on the price, type of offsets your business buys, or the verified traders you buy from, you’ll find that your prices will either shoot up or have no significant change.

It’s also worth knowing that certain types of carbon offsets are tax deductible!

3. For Governments

For governments, all these combined efforts mean that they are moving a step closer in the right direction towards achieving the net-zero pledge. More so, for those governments that are part of the Paris Agreement which includes 197 countries.

I guess it’s also safe to say that the mandatory carbon market has given many governments the legal authority to keep major emitters in check. Otherwise, the rates of emission would have been crazy high and the effects of carbon much stronger than what we’re witnessing at the moment.

When carbon reduction is done effectively and more, better offset projects are supported. So eventually, a country will develop a greener economy that’s built on sustainability and efficient energy solutions.

4. For the Eenvironment

Carbon offsets are not perfect, nor should they stop us from acting systemically. But iIf all the laws and measures put in place to tame CO2 and other greenhouse are upheld, then it means the environment and entire ecosystem will get a significant reprieve.

As things stand at the moment (with the bizarre storms and bushfires wreaking havoc every now and then), we need a quick and absolute solution to the current climate crisis.

Reducing emissions through offsets is a great idea. But we need to step up like yesterday and ensure that we preserve and restore the integrity of our environment.

Planting trees is a good long-term plan but won’t solve the immediate problems surrounding us.

If anything, we need a greater show of unity from the world governments and more aggressive involvement if we are to truly make a difference.

And that’s just it!

Frequently Asked Questions

How big is the carbon credit market?

The carbon credit market varies in scale and size depending on a few factors.

These include your geographical location and the regulations put in place by your government.

Still, it is estimated that the voluntary carbon market stands at slightly over $1 billion as of 2021. For the compliance carbon market, on the other hand, the figures are magnificently larger with estimates quoting up to $272+ billion!

Are carbon credits and offsets the same?

Carbon credits are not the same as carbon offsets.

Credits are carbon limits ‘auctioned’ by the government and allow businesses to emit carbon equivalent to the limit they have bought.

Carbon offsets mainly involve projects geared towards finding tangible solutions that help to reduce and absorb the amount of carbon on the planet. They are more effective in combating carbon emissions than carbon credits.

Which is better, carbon tax or cap-and-trade?

A carbon tax is definitely better than a cap-and-trade.

This is because a carbon tax is placed on every product or service that uses fossil fuel as the primary source of energy. It discourages businesses and manufacturers from using carbon-emitting energy sources and coaxes them into looking for greener alternatives instead.

Cap-and-trade, though, gives businesses the green light to add more carbon into the atmosphere as long as they have paid for a license. Doing this only increases the level of CO2 and other greenhouse gases released and do nothing to reduce or cut it.